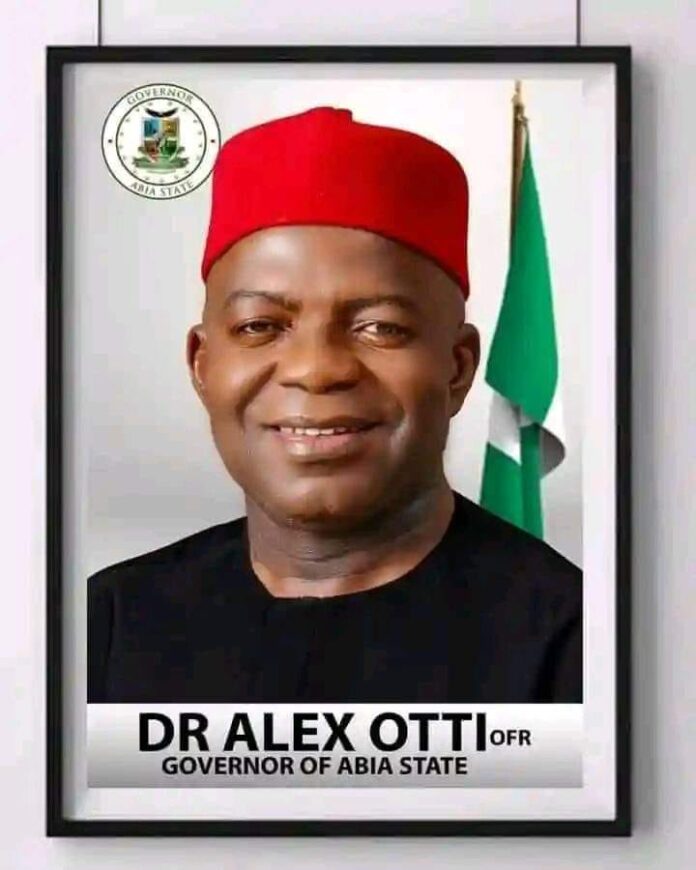

Abia State Governor, Dr. Alex Otti has called on Stakeholders in revenue generation in the State to embrace the newly introduced Digital Tax Regime for Transporters and Traders in the State.

Governor Alex Otti made the call while interacting with Stakeholders in transport and trade at Government House, Umuahia.

He said the new tax regime would eliminate all forms of manual collection of revenue and fraud, increase the revenue base of the State, help in the ease of doing business, attract local and international Investors and help the government fulfill its campaign promises to the people of Abia State.

The Governor further explained that there was need for a more seamless process to collect revenue, adding that, the new tax process is user friendly and anyone that makes use of non internet enabling cell phone would access it while the receipts would be digitally generated and sent through SMS and print out for those that care.

The State Chief Executive used the opportunity to announce that by 1st September, 2023, the State would commence her Treasury Single Account (TSA), where all revenue of the State would be domiciled in one account. Dr. Otti also informed that the tax regime is designed to empower the people and give confidence that payments made to government actually gets to government coffers.

Also speaking, the Special Adviser to the Governor on IGR, Mr. Chimereze Okigbo said the essence of the Town Hall Meeting was to have useful interactions with the necessary Stakeholders given the formal launch of the New Digital Tax Regime.

He said the system is simple and aimed at blocking revenue leakages of the State through elimination of middlemen in government revenue collection.

He said government would profile Agents and place them in various locations to assist in the system to make it seamless.

In their reactions, some Transporters and Traders, including Prince Ndubueze, Cyril Ozor, Ezekiel Nwadibia and Mrs. Chinyere Foster said a lot needs to be done in the motor parks and markets in terms of enlightenment and fixing of internal roads among other things. They stressed the need for synergy among traders, transporters and government for adequate compliance with the new tax regime.